In a notable moment at Sotheby’s recent Modern Evening Auction in New York, a highly anticipated Alberto Giacometti sculpture failed…

Art News

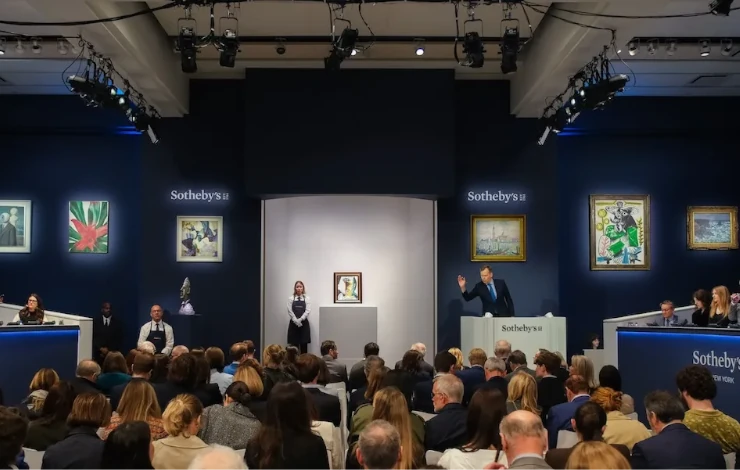

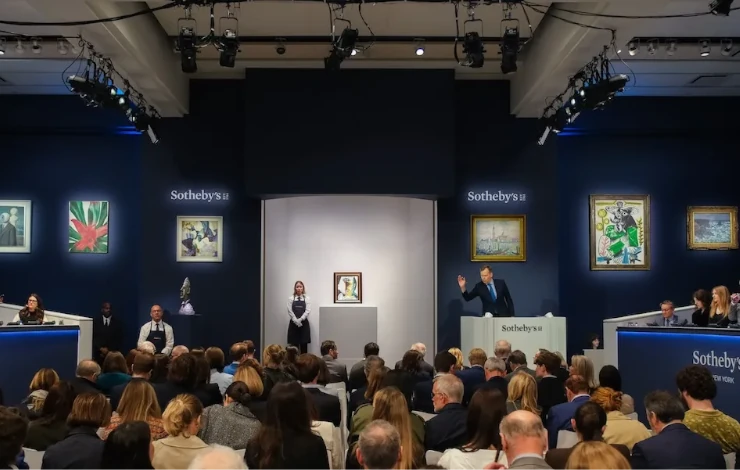

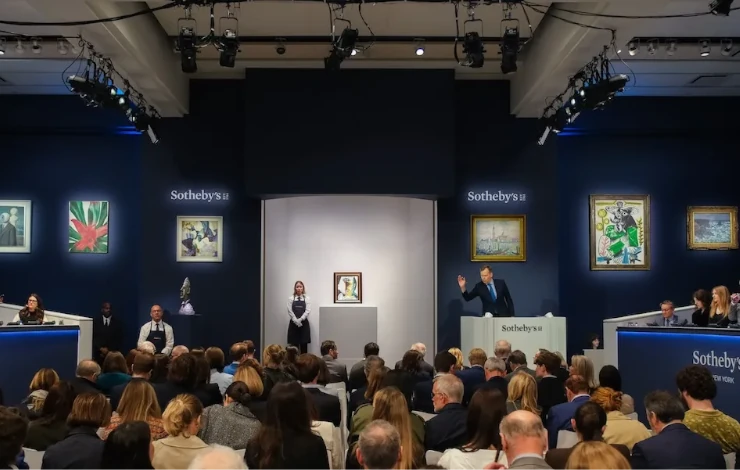

In a notable moment at Sotheby’s recent Modern Evening Auction in New York, a highly anticipated Alberto Giacometti sculpture failed to find a buyer, underscoring growing caution among collectors in the upper echelons of the art market. The bronze bust, Grande tête mince (Grande tête de Diego), created in 1955, was expected to be a marquee lot, estimated to fetch around $70 million. Yet, despite active bidding that reached over $64 million, the sculpture ultimately went unsold after failing to meet its reserve price.

The work depicts Giacometti’s younger brother Diego with the artist’s signature elongated, attenuated features and textured surface. It exemplifies Giacometti’s exploration of the human form, capturing both intimacy and existential fragility through its haunting expression and rough bronze finish. Since its creation, this particular sculpture has been highly regarded as one of the masterworks of postwar figurative art.

The auction house’s decision to present the piece without a financial guarantee—a mechanism that often reassures consignors of a minimum sale price—left the sculpture vulnerable in a market where buyers are increasingly cautious. Initial bidding opened just under $60 million, with several competitive offers driving the price to $64.25 million. However, as the bidding stalled, it became clear that no participant was willing to meet the reserve set by the consignor.

This unsold work accounted for nearly one-third of the evening’s total estimated value, and its failure weighed heavily on the auction’s overall results. The sale brought in around $152 million against a pre-sale low estimate of $240 million, signaling a significant gap between expectations and final outcomes. For Sotheby’s and other major auction houses, this result reflects a wider recalibration of the luxury art market amid economic headwinds and changing buyer behavior.

Collectors and investors in the high-value segment have grown more circumspect due to a combination of global economic uncertainty, geopolitical tensions, and tighter credit conditions. These factors have prompted a shift from blockbuster, ultra-high-ticket acquisitions toward more selective, mid-range purchases and a focus on liquidity and risk mitigation.

Interestingly, while the Giacometti sculpture struggled, other works by the artist and contemporaries found enthusiastic buyers at the same event. Mid-level pieces, including a smaller bronze figure by Giacometti and paintings by artists such as Paul Cézanne and František Kupka, sold at or above their estimates. This contrast suggests that while appetite remains strong for quality art, the ultra-expensive tier is experiencing a pause, if not a correction.

The trajectory of Giacometti’s market has been remarkable over recent decades. His sculptures, with their haunting elegance and psychological depth, have commanded record prices—his Pointing Man famously sold for over $140 million some years ago. Such achievements contributed to Giacometti becoming a symbol of the booming postwar and contemporary art markets.

However, the failure of this particular work to sell signals that even established icons are not immune to the pressures facing the luxury art world today. Pricing strategies and market dynamics have become more complex, with collectors weighing value against financial uncertainty. Sellers and auction houses now face the challenge of balancing optimism for their consignments with realism about current demand.

The unsold bust may well return to the market in the future, possibly under different conditions or at a different venue. Artworks of this caliber rarely disappear from view permanently. For the consignor, patience and timing will be key, as the art market historically moves in cycles influenced by economic trends, collector sentiment, and broader cultural shifts.

For Sotheby’s, the evening was a reminder of the delicate interplay between prestige, price, and market appetite. While blockbuster sales can generate headlines and commissions, sustainable success increasingly requires engagement with a diverse base of collectors and careful calibration of expectations.

The auction also highlighted a subtle but growing bifurcation in the art world. On one hand, there is persistent demand for works at accessible prices that appeal to new collectors and mid-level investors. On the other, there is a more cautious approach toward trophy pieces that command tens of millions, as buyers scrutinize value and risk more closely than ever before.

As the global art market continues to evolve, events like this serve as bellwethers. They reveal shifting patterns in how art is valued, acquired, and traded—not only as cultural artifacts but as assets influenced by financial realities.

Ultimately, the unsold Giacometti bust is more than a single auction outcome. It is a reflection of a marketplace in transition, where even the most revered names must navigate new terrain shaped by economic challenges and changing collector priorities. How Sotheby’s and the wider art world respond in the coming months will be crucial for the future shape of the high-end auction scene.

News Stories

In a notable moment at Sotheby’s recent Modern Evening Auction in New York, a highly anticipated Alberto Giacometti sculpture failed…

The last Manhattan property tied to pop art icon Roy Lichtenstein has been sold, closing a chapter in the artist’s…

The echoes of seaside summers past are alive once more through the vibrant brushstrokes of Brighton-based artist Ruth Mulvie. Her…

In an unusual convergence of intellectual property law, art, and fandom, the pseudonymous artist nicknamed “Zalkian”, operating in the familiar…

A unique auction featuring rare Nepalese artworks has captured the attention of collectors and philanthropists alike, offering not just cultural…

In the heart of Manhattan's Times Square, a bold new public sculpture has ignited conversation and controversy. Towering at 12…

Join our platform

Explore and take advantage of our vast network or galleries, artists and collectors

For Galleries

Take advantage of an extensive network of associates and gain visibility through our platform

For Artists

Get your art in front of hundreds of thousands of eyes and increase your chances to be discovered by collecotrs

For Collectors

Explore and discover a plethora of artists, artworks and art movements, vetted by our curators

A growing network that brings galleries, artists and collectors together, trusted by thousands of associates and partners worldwide.

DATABASES