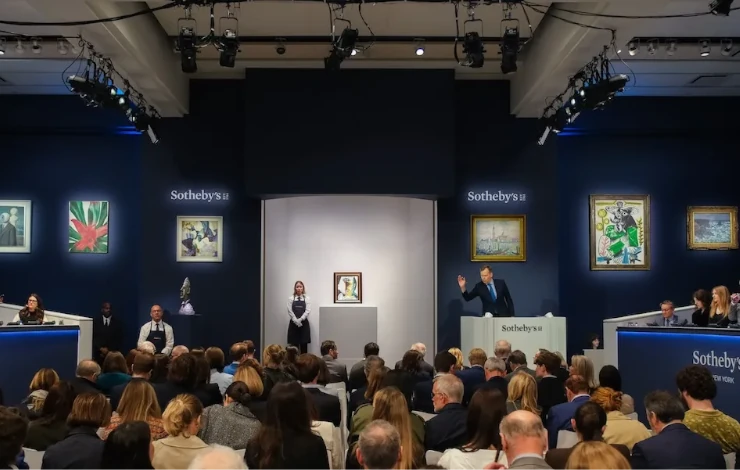

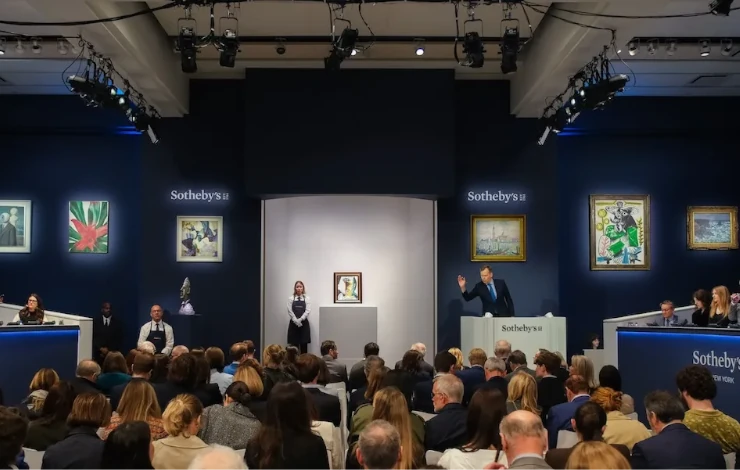

In a notable moment at Sotheby’s recent Modern Evening Auction in New York, a highly anticipated Alberto Giacometti sculpture failed…

Art News

The British art world, long seen as a glamorous and free-spirited domain, is confronting a new and sobering reality. A surge in enforcement actions under anti-money laundering (AML) legislation has placed galleries, dealers, and auction houses under heightened scrutiny—exposing a sector traditionally resistant to regulation to the full weight of compliance law.

Since 2020, when new AML rules began to include art market participants (AMPs), nearly 50 art businesses have been penalized by HM Revenue and Customs (HMRC) for violations. These include failures to conduct customer due diligence, report suspicious transactions, and keep adequate records. While major institutions have largely adapted to the new regime, many smaller galleries and independent dealers are struggling to keep pace with the legal complexities.

The art market has historically operated with a degree of opacity, allowing for private sales and discreet negotiations. But authorities now view this discretion as a liability. The concern is not merely hypothetical. In recent years, artwork has been used to launder money, finance terrorism, and evade sanctions—activities that prompted regulators to bring the art trade under the scope of the UK’s Money Laundering Regulations.

Under the current framework, AMPs must verify the identity of buyers for transactions over €10,000, assess risk profiles, and report anything that appears suspicious. For small or mid-size dealers with limited administrative resources, these obligations can be onerous. While many accept the principle behind the rules, there’s a growing call within the industry for clearer guidance and more proportional enforcement.

Some in the sector feel they’re being treated as scapegoats. “We want to comply,” said a gallery owner in the West End. “But the rules are vague, and the cost of getting it wrong is terrifying. We need support, not just penalties.”

Adding to the strain is the post-Brexit landscape. The UK is now under pressure to demonstrate robust internal controls to preserve its standing as a global financial hub. This places further emphasis on ensuring compliance within high-value sectors like art and luxury goods.

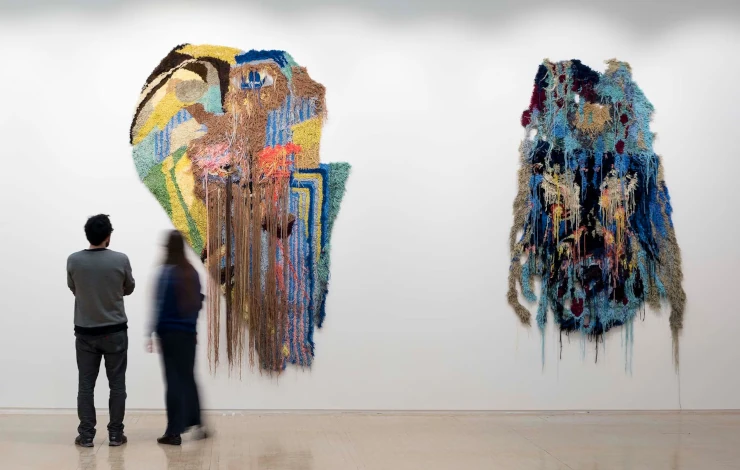

At the same time, there’s growing debate over the balance between transparency and creativity. Critics of the current regulatory approach warn that excessive scrutiny could stifle innovation, particularly among emerging artists and experimental galleries. The administrative burden may deter newcomers from entering the market and force existing participants to prioritize paperwork over artistic engagement.

Still, advocates of the crackdown argue that the art world’s previous hands-off approach is no longer tenable. “It’s a billion-pound industry,” noted one former enforcement official. “You can’t have that kind of financial activity operating outside the rules.”

The Financial Conduct Authority (FCA) has also expressed interest in increasing oversight of art-related financial services, particularly as digital platforms and NFTs expand the boundaries of traditional trading. The challenge, regulators acknowledge, is to protect against abuse without overregulating an industry that thrives on fluidity and trust.

To this end, several trade groups are pushing for more collaborative approaches. Proposals include establishing a regulatory liaison body, improving access to AML training, and providing templated compliance materials for small businesses. Some experts also recommend phased implementation or scaling obligations based on transaction size and business capacity.

In the short term, the art world is likely to face continued discomfort as the rules settle into place. But many believe that transparency, if properly implemented, could enhance trust and attract new investors. After all, reputation is currency in the art market—and compliance may be the next marker of credibility.

As the UK redefines its position in the global economy, the transformation of the art market may prove emblematic of a broader shift: from informality and intuition toward accountability and structure. For now, the brushstrokes of regulation are bold and often heavy—but they may yet produce a more secure and resilient canvas for the future of British art.

News Stories

In a notable moment at Sotheby’s recent Modern Evening Auction in New York, a highly anticipated Alberto Giacometti sculpture failed…

The last Manhattan property tied to pop art icon Roy Lichtenstein has been sold, closing a chapter in the artist’s…

The echoes of seaside summers past are alive once more through the vibrant brushstrokes of Brighton-based artist Ruth Mulvie. Her…

In an unusual convergence of intellectual property law, art, and fandom, the pseudonymous artist nicknamed “Zalkian”, operating in the familiar…

A unique auction featuring rare Nepalese artworks has captured the attention of collectors and philanthropists alike, offering not just cultural…

In the heart of Manhattan's Times Square, a bold new public sculpture has ignited conversation and controversy. Towering at 12…

Join our platform

Explore and take advantage of our vast network or galleries, artists and collectors

For Galleries

Take advantage of an extensive network of associates and gain visibility through our platform

For Artists

Get your art in front of hundreds of thousands of eyes and increase your chances to be discovered by collecotrs

For Collectors

Explore and discover a plethora of artists, artworks and art movements, vetted by our curators

A growing network that brings galleries, artists and collectors together, trusted by thousands of associates and partners worldwide.

DATABASES